Investment Methodology

Rule-based Asset Management.

The way to improve significantly the chances of success.

Our forward-looking investment methodology is the result of sound know-how, clearly defined investment processes and many years of expertise in asset management.

Most investment decisions are made subjectively. At eCAPITAL, we deliberately do things differently. Our investment decisions are rule-based and systematically implemented. This enables us to act free of cognitive limitations. Emotional wrong decisions and uncertain forecasts are avoided.

No “benchmark thinking” but a clear over- and underweighting of the asset classes. This gives investors the potential for an attractive excess return over traditional investment strategies and protection in times of crisis.

Thanks to our specially developed IT infrastructure, we can evaluate up to 28’000 companies based on 100 key financial figures. Of the 100 key figures, we have combined 10 robust criteria that enable us to identify companies with the greatest performance potential. We filter out the best ETFs (more about ETFs ) according to cost, liquidity, tracking error and replication type.

Buy and sell decisions are based on our proven trading signals, which dynamically adapt to current financial markets.

Experience has shown that there are times in the financial markets when it is worth taking risks and times when it is not. Analogous to a weather station, our trading signals indicate whether it makes sense to pack an “umbrella” or not.

Offer

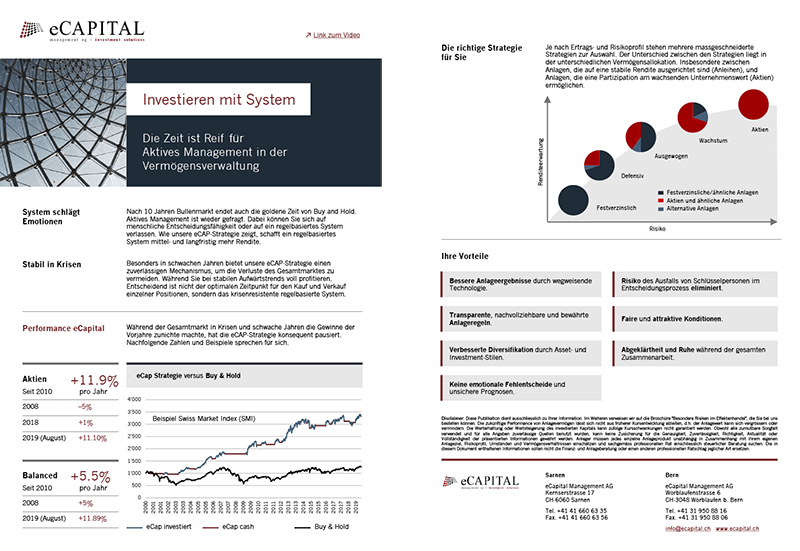

In order to find the right investment solution for you, we consider your risk tolerance, risk capacity and expected returns. You choose the investment strategy and we take care of the rest.

We offer you investment solutions in the areas of equities, bonds, real estate, precious metals, multi-CTA and multi asset portfolios.

The focus is on the relationship between the expected return and the risk taken: we specifically aim for added value in the form of a higher return with lower risk at the same time.

The strategic asset structure is an essential prerequisite for long-term investment success. It is based on the recognition that individual asset classes do not develop in the same way over time. If they are sensibly combined (multi-asset), the risk is lower than when investing in a single asset class.

MULTI ASSET MANDATE / SINGLE ASSET MANDATE

- Based on your individual risk profile, you have the option of selecting the optimum investment strategy for you from five.

- For each strategy, bandwidths are defined for each asset class within which the ratios for bonds, equities, real estate, precious metals, etc. can move.

- You can rest assured that your assets are always invested in line with market developments and your risk profile.

- Our investment strategies can be flexibly adapted to your individual requirements, for example in the selection of asset classes and their bandwidths (e.g. BVG/BVV2), as well as with regard to the targeted risk and return targets.

MULTI-CTA-PORTFOLIO

- You benefit from our expertise in the design and structuring of multi-manager portfolios, which ideally complement equities, bonds and real estate through transparent and liquid trading strategies.

- With eCAPITAL you get inexpensive access to the most successful managers in the world. More than 200 due diligence audits are carried out on site every year. The database comprises over 7,000 managers in 8 countries and three continents. All managers in the portfolio undergo a rigorous quantitative and qualitative selection process.

- We develop solutions for asset managers, banks and insurance companies and manage them for our clients in a sub-portfolio.

Our transparency and objectivity help you to make the right decisions. Our independence allows us to fully focus on your interests and needs.

Advantages

Technology

Better investment decisions due to groundbreaking technology.

Independent

Independent rule-based asset management process.

Transparency

Transparent, comprehensible and proven investment rules.

System beats emotions

No emotional mistakes and uncertain prognoses.

Serenity & tranquility

Serenity and peace during the entire cooperation.

No failure risks

Decision-making process independent of key persons.

Committed Partners

Partners of eCAPITAL are invested in the strategy.

Diversification

Improved diversification through asset and investment styles.

Conditions

Fair and attractive conditions.

Become a Customer

Access your eCAPITAL asset management in three steps.

1. Needs assessment

Personal meeting to understand your needs. What are your investment objectives? How much risk can you tolerate? Which investment solution and which risk profile is appropriate to achieve your goals?

2. Bank account and contract

Asset management contract with eCAPITAL, open an account with one of our partner banks, transfer the investment amount.

3. Implementation and control

Regular reporting, continuous monitoring of your portfolio and personal meetings if required.

Are you interested or do you have any questions? Contact us – we are looking forward to meeting you personally!

We managed assets of private and institutional investors.

We work with private banks, cantonal banks, insurance companies, pension funds, independent asset managers, foundations and family offices.

Frequently asked Questions

Yes, you can arrange for existing investments to be transferred to the custody account managed by us. With eCAPITAL, customers are relieved of all administrative work: Optimized transfer costs, controlled and full transfer of assets. We determine the short-term need for action and provide all positions that initially appear sensible to retain with our hedging system against high price losses.

The implementation of our quantitative investment strategy in a standard solution is ideally possible from an investment amount of CHF 250,000. From an investment amount of CHF 1 million, we can offer tailor-made management solutions.

Your money is deposited with one of our partner banks and covered by the statutory deposit insurance. Each client opens a bank custody account in his name at the beginning of the cooperation, for which we only receive a limited power of attorney. The funds flow exclusively from a client’s account to his custody account and back to his account at the end of the cooperation or in the event of withdrawals. We attach great importance to ensuring that you receive and understand the relevant information in a transparent and comprehensive manner.

Our power of attorney can be terminated daily.

We prefer to work with selected banks. We have agreed preferential conditions with our partner banks and have operational facilities in place.

You decide at what intervals and to what extent you receive reporting. Of course, it is possible to set up an online securities account view so that you can access your securities account balances at any time, regardless of the agreed reporting interval.

We are convinced that investment success in the markets can only be achieved with genuine independence. This is precisely why eCAPITAL is a completely independent financial services institution. This is also reflected in our holistic approach to asset management.

At regular intervals, we will ask you about your investment objectives, your financial situation and your knowledge and experience in order to ensure the suitability of the strategies. If, due to personal, family or financial developments, the previously determined risk appetite no longer suits you, we would ask you to contact us by e-mail at support@ecapital.ch or by telephone at +41 41 660 63 35.