What are Managed Futures?

„Managed futures are not more risky than traditional equity investments.“

Professor Thomas Schneeweis, University of Massachusetts

- Managed futures (monitored by Commodity Trading Advisors or CTAs) is the professional, global and active asset management of different asset classes such as share indices, money market and loan interest rates, commodities and currencies using futures traded on the stock exchange. Managed futures have high liquidity and transparency and are subject to strict state supervision. The oldest and largest futures exchange was founded in 1848 in Chicago under the name Chicago Board of Trade (CBOT).

- The original aim of managed futures strategies was to identify and take advantage of relatively simple trade patterns in the commodities markets, hence the reason for the name ‘Commodity Trading Advisor (CTA)’. During the technological revolution around the turn of the millennium, managed futures strategies, which mostly had purely systematic trading approaches, were used in nearly all highly liquid international financial markets.

Characteristics of managed futures

Characteristics such as high liquidity, attractive returns and limited correlation to all other asset classes make managed futures exceptionally appealing to investors. A significant proportion of institutional investors such as pension funds, banks and insurance companies invest in diversified managed futures strategies.

Investors profit from five unique advantages not available in any other investment vehicle:

Diversification

Managed futures incorporate many investment strategies which are traded over different market sectors (shares, interest rates, currencies, commodities, foreign exchanges) and time frames. Managed futures in themselves are already broadly diversified.

Correlation properties

Returns show a limited correlation with traditional investments such as shares and bonds as well as hedge funds. By including managed futures in a portfolio, risk can be reduced even further and profitability significantly improved.

Transparency

The strictly regulated instruments, traded on the stock exchange, are valued in real-time and always at fair market prices.

Liquidity

Futures and forward exchange markets are highly liquid, exceptional cost-effective and efficient.

Non-directional

Traders can profit from both rising and falling markets.

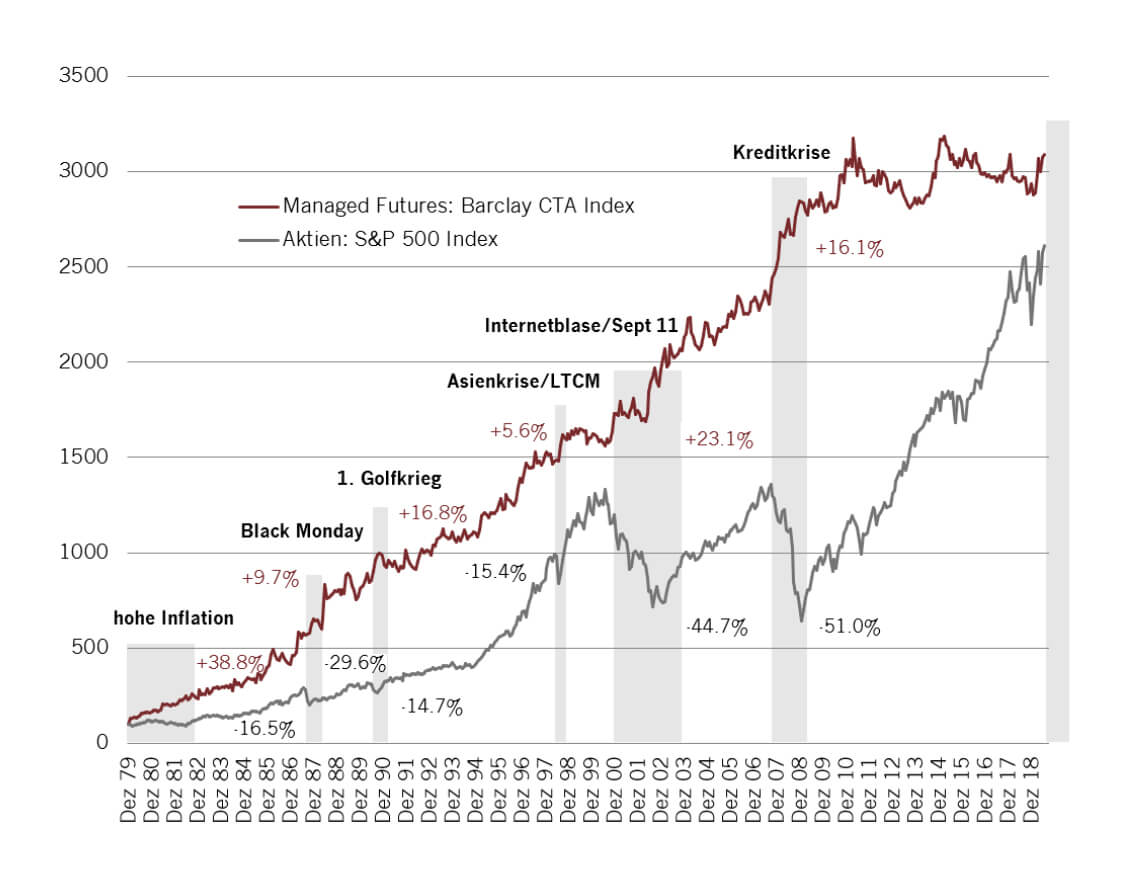

Historical performance

Managed futures achieve better long-term results than shares and bonds and can make a substantial contribution towards portfolio stabilisation, particularly during slumps in the markets. As the time and extent of a market adjustment is rarely predictable, it is sensible to keep part of a portfolio strategically allocated in an optimally diversified managed futures portfolio.

Added value in portfolios

Managed futures are one of the few investment vehicles that can profit from both rising and falling markets. As the following diagram illustrates, the addition of managed futures within a portfolio including shares and bonds provides a valuable opportunity to reduce risk whilst at the same time improving returns.

The best managers in one portfolio

achieve greater returns with lower risk.

- eCapital specialises in structuring and managing multi-manager portfolios that trade with liquid, transparent and cash-efficient instruments. Depending on the volatility, market and time scale, we combine and implement diversifying strategies. Before it is implemented, each trading strategy is tested for months or even years on real accounts.

- In order to allow our clients access to the best managers and trading systems in the world, eCapital has entered into a Fund partnership with Efficient Capital Management LLC, founded in 1999. Based in Chicago, Efficient Capital is one of the market leaders in managed futures. Together with our partner Efficient Capital, we are constantly working on refining our products and services.

- Through eCapital, our clients gain cost-efficient access to the world’s most successful managers. Every year, over 150 due diligence tests are carried out on site. The database includes over 7,000 managers in 8 countries and three continents. All managers in the portfolio go through a strict quantitative and qualitative selection process. Each individual manager as well as the whole portfolio is monitored and managed on an intraday basis.

- eCapital has the specific expertise required for managing and monitoring portfolios. Our infrastructure and methodology fulfil the highest standards set by global banks and institutional investors.

Opportunities and risks

Chancen

- Attractive risk/return ratio

- Opportunity to profit from both rising and falling markets

- Ideal for mixing with traditional share, bond, property and hedge fund portfolios.

- High liquidity and transparency

- Largely unemotional trading due to systematised and tested trading strategies

- Security by limiting losses using a strict risk management system

- Broad diversification across more than 100 markets

- Broad diversification across several managers and strategies, which in turn are implemented across different time frames

Risks

- Volatile performance (based on the concept)

- No capital guarantee

- Currency risk of underlying assets listed in foreign currencies

- Any capital investment is associated with risk. Markets can rise as well as fall. Historical returns are no guarantee of future performance